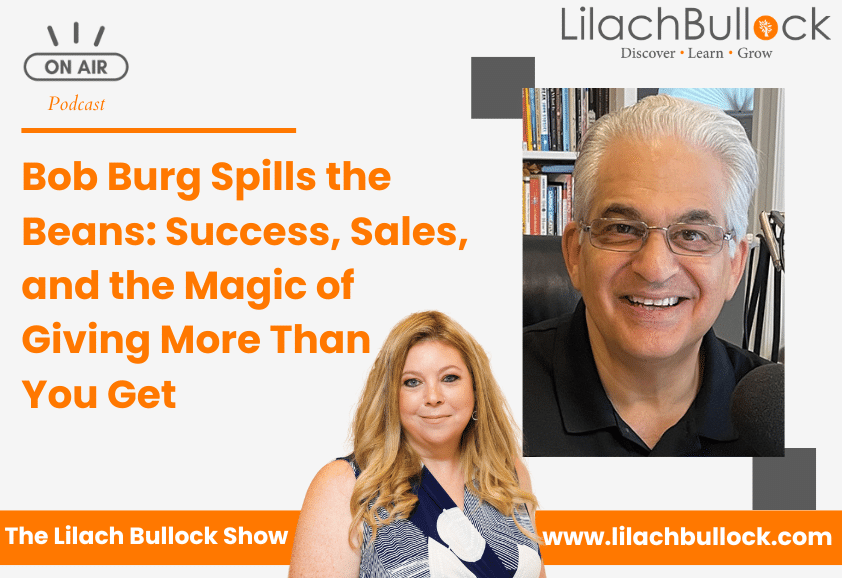

Follow Lilach

How to fund your start-up business [the only guide you need]

So, you want to start a business – you’ve got the idea, the plan, but, of course, you also need the funds to do so. Where do you get them? How can you fund your start-up business idea successfully, and get it rolling? In this blog post, I’m going to share all the main ways for getting startup funding – in the only guide you need.

An overview of startup funding

While there is a plethora of ways of funding your business, as a rule of thumb, all of these methods fall under one of the two following categories:

- Equity

- Debt

With equity, you need to give something away to repay the cash given; usually, it means having a stake in the business. That means, you’ll have people to please – but, at the very least, there won’t be any debt to pay.

With debt, on the other hand, the business is all yours. But, you will have to pay this loan back, in most cases with interest – and within a certain timeframe.

There are upsides and downsides to both ways – but, if you are confident in your idea, in your work ethic and you’re motivated, it’s well worth starting a business, despite the downsides.

[clickToTweet tweet=”How to #fund your #startup business -the only guide you need- via @lilachbullock” quote=”How to #fund your #startup business -the only guide you need- via @lilachbullock”]

You should consider these 2 options very carefully before jumping on either one. When talking loans (and debt), you need to be very honest with yourself on whether you can actually repay the debt in time, or not. Because if you don’t, your business could be taken away from under you, and even your home.

Your business plan needs to be on point and it needs to clearly show your projected earnings.

If you’re considering equity, then you need to consider the downside just as carefully; are you willing to get others involved in your business? Are you ready to let others have decision-making powers over your business?

Another important thing to consider before you start looking for ways to fund your business is exactly how much money you’re going to need. Create a clear plan, so that you know that the sum you came up with is enough to get you started. What’s more, you should also make sure you’re not asking for more than you need; while more money always sounds great, if you’re getting a loan, for example, you need to remember that it needs to be paid back – and usually, with interest.

But now, let’s get into how to get started with funding your start-up business idea:

Startup funding options:

Friends and family

One of the first options (unless, of course, you’ve managed to put down some money of your own that you can use), is to go to your friends and family and ask them for help. This is quite common among those who want to start a business, as it’s a much easier way to get money, then, for example, by using a business loan from a bank.

There are, however, advantages and disadvantages to asking your friends and family to help.

Advantages:

- It’s a quick way to get funding

- Friends/family won’t usually ask for you to pay them back with interest; in some cases, they won’t even want you to pay them back at all (or if you can’t pay them back, they’re more likely to understand – and not take any legal action against you)

Disadvantages:

- Resentment can brew; money makes people act differently, and lending money to friends and family members (especially big sums) can lead to issues in your relationship.

- You probably won’t be able to make as much money as you need like this – but, of course, this depends on your particular family

It’s important to be very upfront with your friends and family when asking for their help; explain what your situation is, what your business is, what you need from them and, perhaps even more importantly, what the risks are for them.

[clickToTweet tweet=”How to #fund your #startup business -the only guide you need- via @lilachbullock” quote=”How to #fund your #startup business -the only guide you need- via @lilachbullock”]

How to fund your start-up business by yourself

If you want to be the one to make all the decisions and don’t want to make any compromises about your business, then the best way to go is to find ways of funding the business by yourself. No banks, no crowdfunding, no asking friends and family for loans.

And, depending on how much of an investment you need to fund your start-up business, it can be done.

Invest your money: Swanest

One of the ways that you can raise money by yourself is to simply invest your money – and grow it. You might not have enough money saved up to start a business, but if you have some money that you’ve been saving, you can use it to invest it and try to grow it.

It helps to start ahead of time, though – to make sure that you can get all the money you need before you start building your business.

One of the easiest ways to get started with investing is to educate yourself (read investment blogs, take a short online course, and so on) and then start investing: either using a professional or trying to do it yourself, with an investment app service.

There are a few good tools out there that can do this, such as Swanest.

It’s very easy to use and there are some very useful features for those who are just starting with investing.

They use a powerful algorithm to evaluate the risk level for any investment opportunity you might find, by ranking it using a number from 1 to 10.

Your investment portfolios can be deeply personalized, based on the countries and companies that you want to invest in.

The service is completely free right now, as they are in beta (pricing will be announced soon).

[clickToTweet tweet=”How to #fund your #startup business -the only guide you need- via @lilachbullock” quote=”How to #fund your #startup business -the only guide you need- via @lilachbullock”]

Advantages:

- If you’re not making enough to save the money yourself, investing is one of the easiest, fastest ways of raising money completely by yourself. All the money you raise is yours, with no strings attached – no interest, no stake in the company, just no strings overall.

Disadvantages:

- You can lose your capital if you invest in the wrong things. Its negative effect will mostly depend on how much you’re starting off with, though.

Crowdfunding

Because of the Internet, crowdfunding has grown a lot in recent years; entrepreneurs, filmmakers, and even people who damaged their windows because of a –let’s-say-unconventional Tinder date.

The way it works is quite simple (and very ingenious): you explain what you want to do and what your business will be, you set different payment options with subsequent rewards for each of them, and regular people will invest in your business.

Ideally, you should create multiple different options for investment, starting from a few pounds to thousands. For every investment, you need to be prepared to offer something in return – and, of course, the more money someone gives you, the more you should give them back.

There are 2 different routes that you can take: reward-based crowdfunding (where you provide rewards for each payment), or equity crowdfunding (where people are effectively investing in your future business, and therefore will have a certain stake in your business).

For example, if you’re selling products, you can give them the product – or, if they’ve only invested a very small amount, you can provide them with a discount once the business and product are live; it’s really all up to you, the important thing to remember is that the reward should match the investment.

Advantages:

- With rewards-based crowdfunding, you don’t have to pay back the money you were given – just provide them with the promised rewards

- You have the potential to raise very large sums (it’s not unheard of to raise over 1 million – pick your own currency – for a start-up business), particularly if you have a really good idea

Disadvantages:

- You might not be able to raise any money (or too little) if your idea – or your presentation of this idea – isn’t getting people to take action

- You’ll have to give back what you promised, with both rewards and equity-based crowdfunding

- You’ll need to manage a multitude of investors, considering it’s likely that a large majority of them will only invest small amounts (£5-£10)

- If you’re going for equity-based crowdfunding, you’ll need to give up stakes in your business

- Once again, with equity-based crowdfunding, you’ll most likely need to keep your investors up to date with everything happening with your business, including your financials.

[clickToTweet tweet=”How to #fund your #startup business w. #crowdfunding via @lilachbullock” quote=”How to #fund your #startup business w. #crowdfunding via @lilachbullock”]

While on paper, it might look like there are quite a few disadvantages to crowdfunding, you shouldn’t dismiss it outright. It’s a great way to fund a business, and so many have done it successfully in the past; it might be a lot of work (and a lot of people to please), but in some cases, the advantages outweigh the disadvantages. And, sometimes, it might just be the only option you have.

One of the biggest success stories in the UK is BrewDog; the craft brewer (which we can now see in shelves all over the country) has managed to raise their desired maximum of £10 million using popular UK-based crowdfunding platform, Crowdcube, with a 7.5% interest rate, a 4 year term and 2699 total investors.

So, although they do have 2699 people to please, the brewer has become one of the most successful start-ups of recent years and still going strong. There are plenty of other success stories, just like Brewdog, in a variety of industries and niches – and your idea could be one of them, too.

To get you started, here are some of the best crowdfunding platforms that you can use to fund your start-up business:

Crowdcube

Crowdcube has been steadily and rapidly growing in recent years, until it got to 48% market share in the UK. It has helped people invest over £338 million in pitches and it has over 429k members.

Crowdcube don’t just have regular people investing on their platform, but also venture capital firms, the UK government, and other types of co-funding institutions, which can help you get a bigger investment. It’s aimed at helping businesses that are in their incipient phases (start-ups and new businesses), but also those who are looking to grow and scale.

Setting up a pitch is easy to do, and you can then start asking for investments from £10 and up. Once your pitch is live and starting to get investors, you can choose to have your investors become legal shareholders in your company, you can nominate Crowdcube to be the legal owner of the investment (so that you only have one shareholder to manage), or a combination of the 2.

Kickstarter

Kickstarter is one of the most well-known crowdfunding platforms available. it works a bit differently to Crowdcube, though; first off, it’s a rewards-based platform, where investors are promised (and given) specific rewards based on their investment.

There are numerous success stories that started out on Kickstarter. The popular platform has helped to successfully fund over 131k projects, raising $3.3 billion from 14 million people.

Another difference from Crowdcube is that on Kickstarter, people are investing in ‘projects’ – not business ideas, necessarily. And, just by spending a mere few minutes on their website, you’ll notice that they tend to prefer “creative” projects, whether they be design/fashion-based, video games, or tech projects, among others.

Because of this, if you have a cool, preferably creative project that you want to fund, Kickstarter is a great choice. If, however, you want to fund a start-up that isn’t necessarily super-creative, you might be better off using other crowdfunding platforms.

Gofundme

Another popular crowdfunding platform is gofundme, which has raised over $3 billion for all kinds of causes to date.

The platform can be used for all kinds of fundraisers; from health problems, to wedding, and from wishes to business ideas, anyone can use this service to try to raise the money they need.

[clickToTweet tweet=”How to #fund your #startup business w. #crowdfunding via @lilachbullock” quote=”How to #fund your #startup business w. #crowdfunding via @lilachbullock”]

That said, it does tend to focus on personal matters, but that’s not to say that you can’t raise money for a start-up as well. There are plenty of businesses in all kinds of niches fighting to get their funding, but you might be more successful here if there’s a good story behind your business idea: perhaps because it’s a dream come true for you, or that it helps your local community in some way.

Some other pluses of using gofundme, are that there are no penalties if you miss your goal, there are no other deadline requirements, and you can keep all the money you were donated.

Crowdfunder

Crowdfunder helps fund projects in all kinds of categories – including business.

When using this platform, you’ll need to share the story of your idea (what it means and where you plan to take it) and then start asking for money – you can either get money in exchange for different rewards, or you can accept donations.

One of the really cool things about Crowdfunder is that they also offer so-called “extra funding” meaning that, in some cases, you could get some extra money from the Crowdfunder partners to help you reach your set goal.

Get a grant

If you’re thinking of getting a loan to fund your business, perhaps it’s better to look at grants first; you might not get a tonne of money, but it might be that you can find enough to get you started – or enough to have to go for a smaller loan, which would still be of massive help (less interest to pay back is always good news).

However, you’ll need to research your options based on your area. Different countries, and even different cities within the same country, have different grant schemes, so you’ll need to spend some time on google trying to find one that is the right solution for you.

For example, there are grants for people under a certain age who want to start their first business; or, if you’re in the EU, there are grants for building sustainable businesses.

If you have the money to start your business, you should check to see whether you can get any grants that pay you back your investment (or, at least, up to certain sum).

Do your research, especially if your other option is getting a loan – loans can lead to big debts, lost houses and other tragedies.

Advantages:

- You won’t need to pay back the money you get

- You’ll have complete control over your business

Disadvantages:

- Grants can be difficult to get; you have to respect certain conditions and even then, it can take a long time to complete the process

- You might not get all the money you need

Government-backed loans

The government (in many countries) also offer some loaning options for start-up businesses. For example, in the UK, you can apply for government-backed loans of up to £25k, either for starting a business, or for growing one, with an interest rate of 6% (you can read more about it and start the application process here).

Whatever country you’re in, check to see what government-backed loans there are available; chances are, you’ll find at least one programme.

Advantages:

- Depending on how much money you need, you could potentially get the full amount you need to get you started/grow your business

- Mentorship programmes: government-backed loans sometimes come with help, which can be incredibly valuable. You’ll get a mentor to coach you through the entire process and help you create a successful business

- You’ll have complete control over your business and whatever decisions you want to make.

Disadvantages:

- It’s a difficult process – and you need to be able to show that you’ve got what it takes to succeed. Generally, you’ll have to provide a finalised, detailed business plan and a realistic cash flow forecast.

- You’ll need to pay back interest rates and keep to your repayment plan; however, it will all be very clear from the beginning, so you’ll know ahead of time how much you need to pay and when

Bank loans

Bank loans are the most popular options among people who want to start their own business.

This is a good option for those who have a good business idea, one that they really trust in, who have a good credit score, good collateral, or a history in starting successful businesses in the past. Essentially, if you can prove to the bank that you’ve got what it takes to give them their money back – with interest, of course.

If you’ve already got a good relationship with your bank, you’ve got your foot in the door already. If you don’t, don’t worry – it’s still in their interest to find good business ideas that they can fund.

[clickToTweet tweet=”How to #fund your #startup business w. loans via @lilachbullock” quote=”How to #fund your #startup business w. loans via @lilachbullock”]

Advantages:

- You retain complete ownership of your business, with no equity given to anyone else

- You could potentially be able to secure the full amount you need

Disadvantages:

- It can be difficult to secure a bank loan, depending on your history, as I mentioned earlier.

- You’ll need to repay everything, and usually, with pretty big interest rates, on exact dates or else your bank will find other (unpleasant) ways of making their money back

Open a credit line

If you don’t need a huge investment to fund your start-up business and you have a good credit score, you could try opening a credit line with a bank, instead of going for a loan. While you still need to repay what you spend (with interest, of course), the repayment schedule is usually not nearly as gruelling as with bank loans.

Advantages:

- It’s a quick way to get some extra money (depending on the credit limit, you could have access to the money in days)

- You can spend the money on whatever you want (which is a blessing as much as a curse!)

Disadvantages:

- You might not be able to secure the whole amount you need

- You’ll need to repay the money and once again, interest rates can be quite hefty

Angel Investors

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/office-620822_1920-1024x680.jpg) Angel investors can bring you big bucks – even hundreds of thousands of pounds if that’s what you need to get your start-up business off the ground. However, you’ll need to be prepared to give away a share of your business.

Angel investors can bring you big bucks – even hundreds of thousands of pounds if that’s what you need to get your start-up business off the ground. However, you’ll need to be prepared to give away a share of your business.

Angel investors are usually entrepreneurs themselves (successful entrepreneurs, at that). This means that if they believe in your idea, they could choose to invest the full amount you need.

Not only that, but they’re also more willing to disregard risks if they believe in you and your business idea.

If you choose to go this route, it’s important to understand that this is not a loan – you won’t have to give them back their money, but you will have to give them a stake in your business and they will most likely get involved in the process. This can be both a con and a pro; for one, if they’re entrepreneurs themselves, then they can help you with advice and invaluable tips that will help you create a successful business. On the other hand, it also means you won’t have complete control over your business; depending on the deal the 2 of you have made, you’ll most likely have to consult with them about business decisions.

Advantages:

- Raise the full amount you need to start your business

- Get advice and help from successful, established entrepreneurs

- As this is not a loan, but an investment, you don’t need to pay back your investors

- Angel investors are much more likely to take on ‘risky’ ideas, if they believe in them; with bank loans and other types of loans, the riskier the business is, the less likely it is they’ll approve the loan

Disadvantages:

- You’ll need to give away a stake in your company to the angel investors you secure, so you won’t be the sole decision maker

- Even though you don’t have to pay them back, they will want to make their money back – and then some. You won’t have to break the industry in the first year, but most angel investors will expect to make their money back and a decent profit within the first 5 years.

[clickToTweet tweet=”How to #fund your #startup business w. angel investors via @lilachbullock” quote=”How to #fund your #startup business w. angel investors via @lilachbullock”]

How to find angel investors

Now that we’ve gone through what angel investors are and the pros and cons of using them to fund your start-up business idea, the question is: where do you find these angel investors?

One option (that we discussed earlier) is to look at your friends and family – but, that might not always be a possibility (after all, not many have incredibly rich friends/family, with huge disposable incomes).

Another option is to find an angel investor by yourself, and approach them directly. This can be very difficult to do, however, as many angel investors are anonymous (or at least, they don’t advertise themselves).

In order to find them directly, you need to keep a very close eye on your industry – who is buying/selling companies, who is investing and so on.

The best – and easiest – way to go, however, is to use angel investor networks. Using these networks is much easier for everyone involved – both for you, as you won’t have to search incessantly for potential investors and try to find a way to get in contact with them, and for them as they can collaborate with other angel investors, keep their anonymity and find the best opportunities for them.

Here are a few top angel investment networks:

- Angels Den – Angels Den is a top angel investor network where businesses can easily post their pitch in order to get investors. Its aim is to help businesses that need between £50k to £1 million and, of course, to help its investors find the best possible opportunities to invest into.

- Angel Investment Network – a worldwide angel investor network that works in Europe, North and South America, Asia and Oceania, Africa and the Middle East.

- Gust – Gust is a platform designed to help start-ups find investors and get funding; they cover cities and countries all over the world and all kinds of industries (food & drink, web services, B2C and B2B products and services and much more) and have helped raise over $1 billion in funding for start-ups.

Conclusion: startup funding options

Funding a start-up business can be tough, but it can be done – and in fact, there are a lot of different funding routes that you can take, all with their own pros and cons. The most important thing that you need to consider is whether you’re OK with having someone else to have a stake in your company, or whether you’d prefer paying back the loan while keeping complete ownership of your business.

But, before looking into getting outside funds for your start-up, it’s also worth looking into your own finances and capabilities, because, depending on how much money you need to raise, you might be able to get the funds all on your own – through careful investing, through friends and family, and so on.

Are you looking to fund a start-up business idea? And if so, what challenges are you facing? Which route do you think is best? Leave your comments below and please share if you enjoyed the post 🙂

Follow Lilach

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/swanest.png)

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/crowdcube.png)

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/kickstarter.png)

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/gofundme.png)

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/crowdfunder.png)

![How to fund your start-up business [the only guide you need]](https://www.lilachbullock.com/wp-content/uploads/2023/01/london-530055_1920.jpg)